Market Position Statement 2025 - 2040 Community-Based Services - Homecare

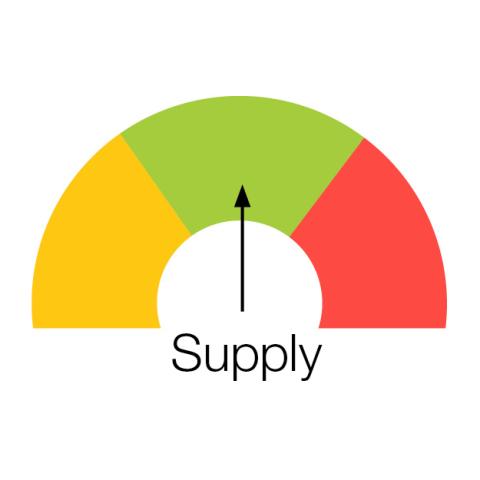

The diagrams below are a judgement by commissioners of the sufficiency of supply, quality of services and stability of the homecare workforce in Walsall.

Market Rating – Supply Of Homecare

Current supply of homecare in Walsall is rated green. It is rated green for the sufficiency of supply. However, consideration needs to be given to whether there is too much homecare supply to meet current and future demand and how supply is re-shaped to ensure sustainability of business and services.

Market Rating – Quality Of Homecare

The quality of homecare services in Walsall is rated as ‘Amber’. Good or Better CQC ratings for registered and rated homecare services in Walsall is currently at 68.1%. This is broadly comparable to West Midlands neighbouring council figures. This is a slight improvement on recent years but there is still a significant proportion of homecare services that are CQC rated ‘Requires Improvement’.

Market Rating - Workforce Stability

The stability of the homecare workforce in Walsall is variable and rated as ‘Amber’. There is a local workforce in Walsall, but international recruitment issues are currently putting the overall workforce at some risk. There is a Black Country-wide international recruitment action plan and local action in Walsall to mitigate risks.

Overall Current Market Status

The current homecare market in Walsall is rated as sufficient in terms of supply, but not at the quality required overall as a market. There is good quality provision in the Borough as exemplified by many providers, but there needs to be a new approach to driving up the quality of all homecare provision in the Borough. Sector-led improvement would support this.

Please contact us if you want to work with the Council and partner agencies on continually driving up the quality of your services.

The Walsall homecare workforce also needs stability and growth. Sufficiency of supply is dependent on sufficient, trained and skilled workforce.

Please contact us if you wish to work together on recruitment and retention of your care staff.

Changes away from time and task commissioning with the end of CM as a payment mechanism for homecare in late 2024 have been replaced by payment on plan for providers. This move to payment on plan will now assist the gradual move to outcome-based commissioning.

This is a preferable move and it will drive changes in commissioning, care management and brokerage practice as well as in quality assurance of homecare services and payments. Walsall Council is also initiating a pilot project in 2025 called ‘Live Well at Home and in Your Community’ to test outcomes-focussed commissioning and delivery of homecare and connections into other services based in communities. This is to inform the strategic re-commissioning of CBS services in Spring 2027.

New providers considering entering into homecare need to be aware that, on the whole, current supply outstrips demand and is being met by existing strategic or framework providers on our Live at Home Framework. You may wish to consider investigating specific areas of hard to source locations or specialist types of care, such as more complex needs. The Council anticipates that some providers may exit the market due to lack of supply or due to quality or workforce supply issues.

Provider Dimension

The current Community Based Services (CBS) Framework including homecare commenced on 3rd April 2017 and has an 8-year term. This has been extended by two years, therefore the Framework expires on 31/3/2027. A new Framework will be place for 1st April 2027. Providers will need to retender for this Framework. There will be market co-design of future models and market engagement and testing in the next 24 months.

The CBS Framework is therefore in its final stages. The Council and providers will work together to co-design new models of homecare and events will be put in place soon to facilitate this. The current framework contains 8 LOTS including older people, mental health functional, mental health dementia, rapid response, reablement and Extra Care Housing. For CBS, there is a process where spot contracts can be awarded to a provider where a Framework provider does not have capacity or capability requirements. Currently an estimated 38% of placements are made through this process. This needs to be reviewed and addressed in the new re-commissioning process.

Some commissioned providers are using digital technology to manage care provision. However, the extent to which this is used varies - some providers are using technology to manage all aspects of their business including the management of staff as well to support care planning and delivery (using electronic rostering, electronic homecare monitoring (EHM), digital social care records (DSCR) and electronic medications administration records). We want more providers to be using digital methods to operate their businesses and there is support for this now from a dedicated commissioning lead for digital. Contact adultsocialcarecommissioning@walsall.gov.uk for more information on TEC and digital.

Market Risks

Market Risks There are several key risks associated with the commissioning of the homecare market in Walsall currently:

- There are currently potentially too many providers operating in the Borough to ensure business viability for all homecare providers.

- Many providers can meet low level care needs, but evidence suggests there are not enough providers able to meet more complex needs at rates commensurate with that demand.

- Time needed to work together with the market to move to an outcomes -based model for homecare - the ‘Live Well at Home and in Your Community’ pilot project in 2025 will help this.

- Rates paid to Walsall providers are lower than most West Midlands comparator authorities although the 25/26 uplift is improved from previous years.

- Quality of homecare in general needs improvement.

- Need better understanding of self-funding client numbers and needs in Walsall and ensuring sufficiency and choice of supply for self-funding clients. It is estimated that 23-24 % of homecare service users in Walsall are self - funders.

- There are real workforce risks related to retention and recruitment of homecare workers in the Borough.

Distance From Vision For The Future For Homecare

Our vision for homecare is to “Grow and shape services that meet a range of needs in people’s own homes and communities to help maintain independence, enable people’s outcomes and to prevent and delay the need for long-term care and support options for as long as possible”.

There are positive aspects of the current market, particularly the local nature of homecare, diversity of supply and the number of suppliers in Walsall. This is a very important asset and economic factor for the local economy employing local people. However, over the next 18 months, the Council, partners like the ICB and providers need to go on a significant journey with providers to co-produce these models embedded in time for the new contract that will go live in Spring 2027.

Market Opportunities

- Opportunity to co-design with providers and partners the homecare model in Walsall and to be part of the pilot in 2025-2026 testing new ‘Live Well at Home and in your Community’ models.

- Possibility of moving to more of a strategic partner(s) model and/ or locality lead provider(s) models working more in partnership with VCSE organisations.

- Opportunity for the Council to work with providers and partners to invest more in driving up the quality of homecare through training, piloting TEC.

- Opportunities to commission homecare in areas of the Borough with high current and predicted demand but lower supply.

- Opportunities to fill gaps in types of homecare provision such as clients whose behaviour challenges, dementia focussed homecare and some of the other specialisms needed in homecare.

- Opportunity with the cessation of CM to start the move to a more outcomes focussed approach to homecare. Payment by plan is now in operation which is a key step in that journey.